Sales of meat substitutes in Japan grows by 5% CAGR

Health-conscious youths are increasing sales of meat substitutes in the market.

The Japanese meat substitutes market is set to register a compound annual growth rate (CAGR) of 5% to reach JPY36.3b ($373.5m) by 2026, data and analytics firm GlobalData said.

GlobalData’s report, “Japan Meat Substitutes - Market Assessment and Forecasts to 2026,” reveals that the market growth will be spearheaded by the soy-based category, with the fastest value CAGR of 5.1% over the forecast period, and the grain-based category with a 4.7% CAGR. The high affinity for soy-based meat substitutes stems from the fact that soy-based foods, such as soy sauce and miso, are deeply ingrained in traditional Japanese cuisine.

“The availability of meatless meat options in retail stores during the COVID-19 pandemic accelerated consumer awareness and first-time purchases. The long shelf-life of meat substitutes attracted Japanese shoppers as they stocked their pantries to avoid frequent trips to grocery stores. The market gained momentum as more brands entered the fray and rolled out diverse product types, customized for Japanese palates. As the COVID-19 regulations were eased, and foodservice venues reopened in 2021, leading operators cashed in on the veganism trend, launching animal-free meat dishes, thereby popularizing meat substitutes,” Bobby Verghese said.

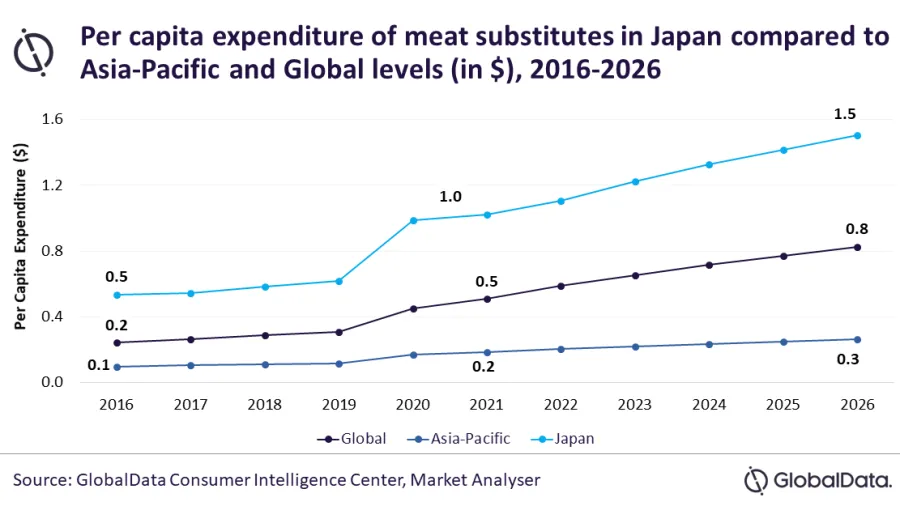

Consequently, the per capita expenditure (PCE) on meat substitutes in Japan increased from $0.5 in 2016 to $1 in 2021, surpassing the regional PCE of $0.2 and the global average of $0.5.

“Health, safety, sustainability, and taste are the key factors stimulating the purchase of meat substitutes in Japan. Western food trends are also strongly influencing young Japanese consumers to adopt flexitarian and vegan lifestyles. Japan’s PCE on meat substitutes will therefore rise to $1.5 by 2026,” Verghese said.